Applied For A New Credit Card? Here’s How You Can Check Your Application Status

Credit cards are plastic money and one of the most convenient options for transactions. If you have applied for a credit card recently and want to check your credit card status, you can resort to both online and offline methods. When you apply for a credit card in India, the banks and NBFCs display the credit card application status on their website. The customers can check their credit card status there or in person.

Let us have a look at what details you should keep handy while checking your credit card status

- Application number you received at the time of credit card application

- Your registered mobile number

- Your PAN card

- Your date of birth

Now that you have understood the requirements, here is how you can check your credit card application status via online and offline modes.

How to Check Credit Card Application Status Online?

You can check the credit card application status online through the bank or NBFC’s website or via email. The following are the steps for both of these ways. Please note that these steps work for the majority of card issuers in India.

- 1. Through the official website

-

- Visit the card issuer’s official website.

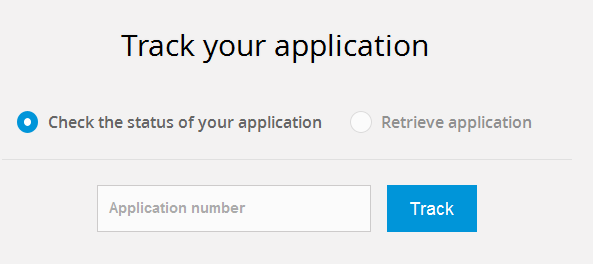

- Go to the credit card section and choose the ‘track application status/check application status’.

- Enter the required details like application number, PAN number, mobile number, date of birth, etc.

- Click on ‘Submit’ and the website will display your credit card application status.

- 2. Through an email

-

- Visit the card issuer’s official website.

- Go to the ‘Contact Us’ tab.

- Get the mail ID and write an email with your request for knowing the credit card application status.

- Add your details like application number, PAN number, mobile number, date of birth, etc in the mail.

- Send it to the email address.

Also read: Understand The Importance of Having the Best Life Insurance

How to Check Credit Card Application Status Offline?

You can choose offline options like contacting customer care, sending an SMS, or visiting the card issuer’s nearest branch. Here are the steps you should take for each of these offline ways.

- 1. Through customer care

-

- Dial the credit card issuer’s customer care number and talk to an executive.

- Give your credit card application number when the customer support executive asks for it.

- They will inform you about the credit card application status.

- 2. Through an SMS

Most credit card issuers provide the facility to check the credit card status through an SMS. All you have to do is send the SMS in the correct format to the right number from the mobile number registered with the bank. The credit card status will be sent to you through a reply SMS.

- 3. By visiting the nearest branch

You can always pay a visit to the nearest branch of the credit card issuer to enquire about the status of your credit card application. The executive at the helpdesk may ask you for the application number as well as the registered mobile number to disclose your credit card application status.

What are the Different Credit Card Status Types?

An array of changes occur to your credit card application status from the time you apply for a new credit card till it is issued. Here are some of the common credit card statuses you could find while checking for your credit card application status.

| Credit Card Application Status | Meaning |

| In-progress | The In-Progress status depicts that the card issuer is still analysing your application and is yet to decide. |

| Approved | An approved status indicates that your application is approved by the issuer and you will receive your credit card soon. |

| Dispatched | The dispatched status appears only if the issuer has approved your application and sent out your credit card. Your card will be en route, and you will receive a letter or an email regarding the approval with the Air Waybill number in it. You can use this Air Waybill number to track down the location of your shipment containing the credit card. |

| On-Hold | The on-hold status implies that additional information is required to process your credit card application, and the process is kept on hold till it is provided. You will also get a call or a message from the credit card issuer regarding these necessary documents. |

| Disapproved | The disapproved or rejected status indicates that your application did not meet the eligibility parameters required to issue the credit card. |

What are the Steps to Check Top Banks’ Credit Card Application Status Online?

Here are the steps to check some of the top banks’ credit card application status.

- 1. SBI Credit Card Application Status

-

- Visit the SBI official website.

- Go to the tab under ‘Credit Card Application’ and select ‘Track’.

- Enter your credit card application number.

- Now, click on ‘Track’.

- 2. ICICI Credit Card Application Status

-

- Visit the ICICI Bank official website.

- Go to the credit card application status section.

- Enter your application number and mobile number. If not, enter your registered mobile number, date of birth, and the OTP sent to you.

- Click on ‘Continue’, and the status will appear on the screen.

- 3. Axis Credit Card Application Status

-

- Visit the Axis Bank official website.

- Go to the credit card application status section.

- Enter your application number, the PAN number, or your registered mobile number as per choice.

- Click on ‘Submit’, and you can find the status on the screen.

- 4. Citi Credit Card Application Status

-

- Visit the Citibank official website.

- Go to the credit card application status section.

- Enter the 11-digit application number you received through SMS and your registered mobile number.

- Click on ‘Continue’, and the status will appear on the screen.

——————

Great knowledge